Cashfree • UPI • SMEs

What is Cashfree? Beginner’s Guide to India’s Free UPI Payment Gateway

Understand Cashfree, setup steps, settlement time, and the benefits for small businesses. Includes signup link, finance tools, and recommended hardware.

👉 Sign Up Free on CashfreeExplore Finance Products

Contents

- Introduction

- What is Cashfree?

- Why choose Cashfree over PhonePe/Paytm QR?

- Key Features

- How to Create a Cashfree Account

- Recommended Tool (Amazon)

- Settlement Time Explained

- Benefits for Small Businesses

- Finance Tools for Growth

- FAQs

- Conclusion & Signup

Digital payments in India are booming. While PhonePe and Paytm are common for basic QR collections, Cashfree adds business-grade features like GST-friendly reports, settlement controls, payment links, payouts, and developer APIs—without sacrificing free UPI collections.

Looking for banking & lending products alongside payments? Check our curated solutions: Finance Product Website.

What is Cashfree?

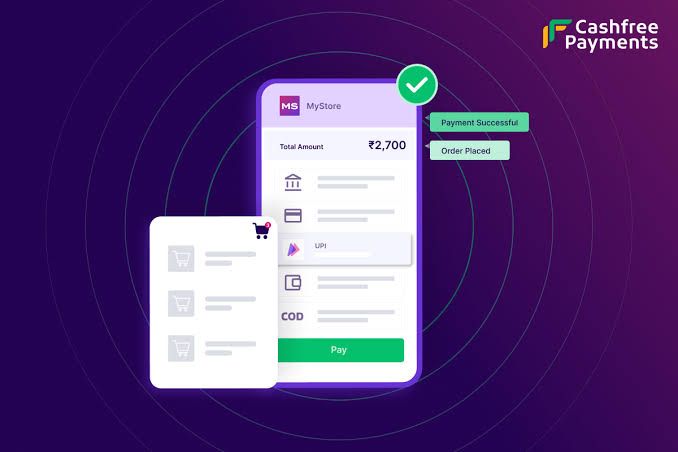

Cashfree is a full-stack Indian payment gateway that lets businesses accept UPI, cards, net-banking, and wallets, plus automate payouts, use AutoCollect (virtual accounts), and manage subscriptions. It’s designed for shops, D2C brands, freelancers, institutes, and SaaS startups that need more than a simple QR code.

Why choose Cashfree over PhonePe/Paytm QR?

- UPI at 0% MDR (merchant keeps full amount) with business-class features.

- Dashboard & reports that simplify reconciliation and tax filing.

- Scale seamlessly: add cards, EMI, and international payments later.

- Professional branding with payment links/invoices vs. personal QR numbers.

Ready to experience this? Create your free Cashfree account.

Key Features

- Free UPI collections (0% MDR)

- Same-day / next-day settlements with transparent tracking

- Payment links, invoices, subscriptions, and checkout pages

- Payouts to vendors, staff, and creators

- Developer-friendly APIs & plugins (Shopify, WooCommerce, WordPress)

How to Create a Cashfree Account (Step by Step)

- Click Sign Up Free on Cashfree.

- Enter business email, phone, and PAN/GST details.

- Complete KYC verification and add a settlement bank account.

- Start accepting UPI (and later cards, EMI, etc.).

👉 Create Your Free AccountBrowse Finance Solutions

Recommended Tool for Shops (Amazon)

To speed up checkout and improve billing, many shops use a compact POS/thermal printer or barcode scanner. Here’s a recommended pick: Recommended POS/Barcode Tool for Small ShopsFast billing • Compact • Budget-friendly • Works with most POS appsView on Amazon

Prefer a different model? Browse the best POS options on Amazon.

Cashfree Settlement Time Explained

Most merchants receive T+1 (next business day) settlements by default. Eligible businesses can opt for same-day settlement windows. All events show up in the dashboard with date/time stamps for clarity.

Benefits for Small Businesses

- Keep 100% of UPI collections while getting enterprise-grade tools.

- Automate billing and get GST-ready reports.

- Upgrade to cards/EMI/international without changing providers.

Finance Tools for Business Growth

Beyond payments, you may need working-capital options, cards, and savings products. Explore our curated options here: Finance Product Website.

FAQs

Is Cashfree UPI free for merchants?

Yes—UPI collections are free (0% MDR), so the full amount is credited to the merchant. What are the charges for cards or wallets?

Typically ~1.9%–2% per transaction for cards/wallets. UPI remains free. Can freelancers or small shops join?

Absolutely. You can start with PAN and a valid bank account; GST helps for advanced features.

Conclusion & Signup

Cashfree combines free UPI with business-grade features—perfect for shops, freelancers, and growing SMEs.

👉 Sign Up Free on CashfreeExplore Finance ProductsBest POS Tools on Amazon

Disclosure: This page contains affiliate links. If you sign up or purchase through them, we may earn a commission—at no extra cost to you. As an Amazon Associate we earn from qualifying purchases.